Meta’s $14.3B Investment in Scale AI: Building the Foundation for Enterprise AI

The AI landscape is undergoing a tectonic shift. Meta's now-finalized $14.3 billion investment for a 49% non-voting stake in Scale AI marks one of the largest deals in the history of enterprise AI. Just as significant is what the deal signals: the era of AI as a consumer-facing novelty is giving way to AI as critical enterprise infrastructure. At Good AI Capital, we’ve long believed that the future of AI lies in enabling organizations to harness its full potential in secure, domain-specific, and operationally impactful ways.

The Deal: $14.3 Billion for 49% — But No Control

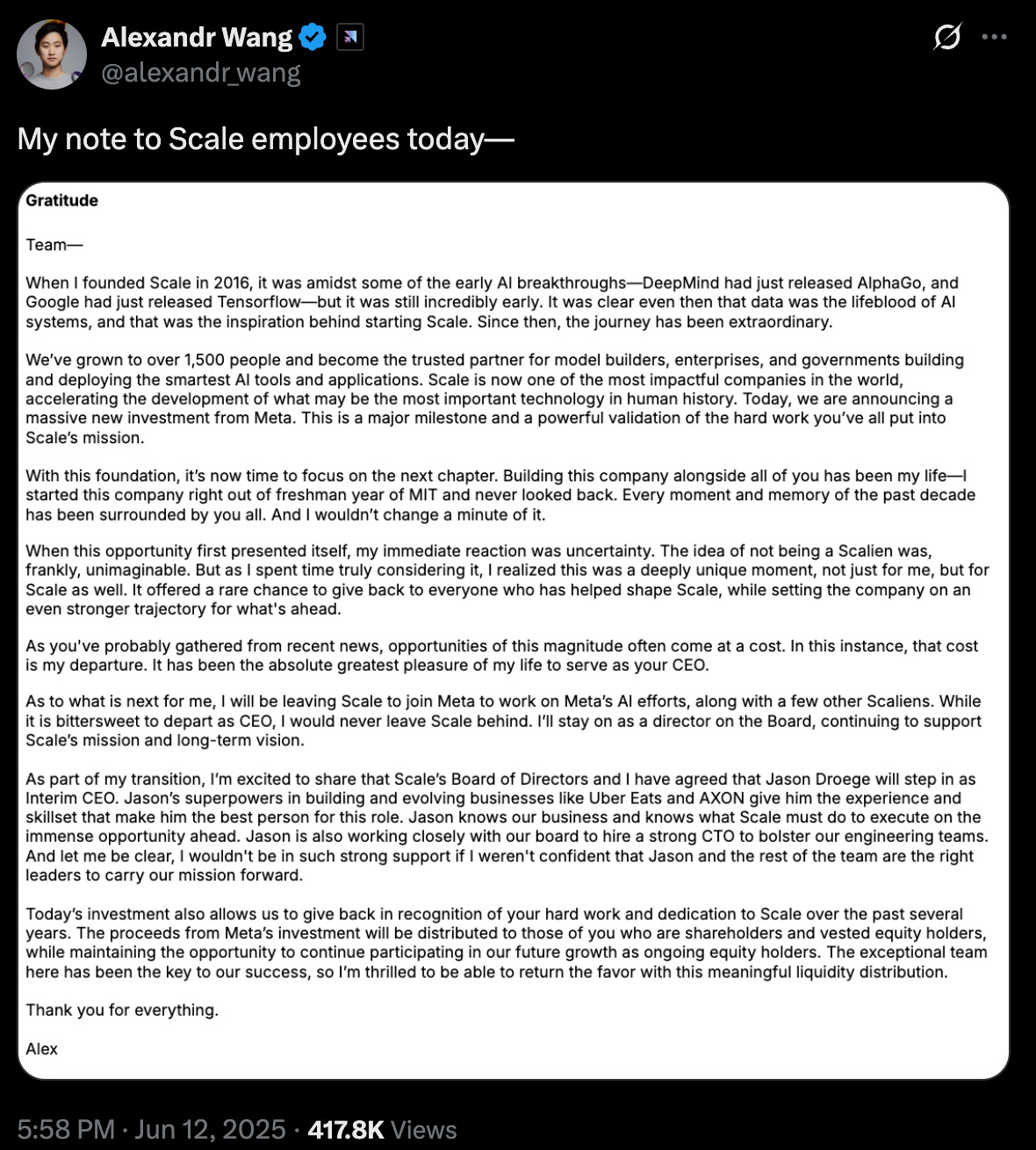

Meta is investing $14.3 billion to purchase a 49% stake in Scale AI. However, this isn’t your typical acquisition. The shares are non-voting, and control remains with Scale’s CEO Alexandr Wang—who is stepping away from operational leadership to join Meta full-time, leading its new superintelligence team.

This structure is strategic. Meta gets access to Scale’s unmatched AI data infrastructure and talent without triggering a full regulatory review or merger challenge by the DOJ. Scale’s governance remains independent, and Wang—not Meta—controls the company’s direction, even as he transitions to a full-time role at Meta. Meanwhile, early investors in Scale—Accel, Index Ventures, and others receive liquidity without ceding upside, as this was structured as a secondary sale.

Importantly, this structure preserves significant future upside for both remaining investors and employees. Jason Droege, currently Scale AI's Chief Strategy Officer and formerly of Uber, will step in as Scale’s new CEO, and a search is underway for a new CTO. With Meta providing deep capital and strategic alignment—but no direct control—the path is open for Scale to continue operating independently and grow its enterprise and government footprint.

That means the company still has the potential to pursue a larger strategic exit or IPO down the line—critical for retaining and incentivizing top talent. Equity continues to matter, and so does the ability to innovate autonomously. This isn’t a cash-out; it’s a reset for long-term growth.

The Microsoft and Google Playbook

Meta is not alone in navigating around regulatory scrutiny while still making major AI talent acquisitions. Microsoft’s $650 million deal with Inflection AI allowed it to onboard co-founder Mustafa Suleyman and nearly the entire team—without acquiring the company. Similarly, Google hired Character.AI’s founders and team while licensing its models, in a structure that raised eyebrows but skirted traditional antitrust thresholds.

These are not isolated moves. They’re part of a broader strategy by Big Tech to acquire strategic assets in AI while avoiding full-scale takeovers. It’s M&A for the age of antitrust.

What Scale AI Does

Scale AI is a data-labeling and evaluation platform for training AI models:

It combines machine learning and human-in-the-loop annotation to label images, video, text, audio, 3D, maps, and more.

It offers tools for data curation and model evaluation, including red-teaming and safety benchmarks (e.g., SEAL Lab and “Humanity’s Last Exam”).

It enables Reinforcement Learning from Human Feedback (RLHF)—a crucial step for fine-tuning large language models.

Scale serves elite customers including OpenAI, Google, Microsoft, Meta, the U.S. Department of Defense, Qatar, Toyota, and Uber.

Subsidiaries like Remotasks and Outlier.ai handle crowd-sourced annotation, initially for vision and autonomy, and now for LLM use cases.

In 2025, Scale is projected to double its revenue to about $2 billion and has previously been valued as high as $25 billion in potential tender offers.

Why Meta Needed Scale

Meta has lagged behind rivals like OpenAI and Anthropic in the LLM race—not necessarily in model quality, but in perception, ecosystem depth, and infrastructure. Its Llama 4 model, "Behemoth," was a disappointment, and it lags in other areas, such as reasoning, video, and voice. Mark Zuckerberg reportedly aims to compete in all these areas and has been holding regular meetings with the AI team to monitor progress closely.

After the fallout from Llama 4, Zuckerberg overhauled the division’s structure and began assembling a so-called "Superintelligence Team"—which Alexandr Wang is now expected to lead. Still, insiders report confusion within Meta’s AI unit about the strategy and direction.

With this deal, Meta gains:

Access to best-in-class data infrastructure

Immediate enterprise AI channel exposure: Unlike Microsoft (with Azure and OpenAI integrations) and Google (via Vertex AI and Workspace), Meta has historically lacked a strong enterprise distribution channel for AI. This deal helps Meta build a credible foothold in enterprise AI, opening doors to government, defense, and Fortune 500 clients through Scale’s existing relationships.

Talent acquisition through Alexandr Wang’s integration into Meta

It’s a massive vote of confidence in infrastructure-first AI—and a sign that Meta sees enterprise adoption, not just consumer dominance, as the next frontier.

From Consumer AI to Enterprise AI

In our previous blog post, we highlighted how AI is evolving from consumer-focused novelty to enterprise-grade tools. This deal validates that thesis. Enterprises today aren’t just playing with ChatGPT—they’re demanding secure, auditable, and integrated AI that works across their internal systems. That’s what Scale provides.

And Scale is not alone. Just last quarter, enterprise AI startup Glean raised $260 million at a $4.6 billion valuation. Glean is building AI-native enterprise search and assistant tools that respect permissions and integrate across SaaS environments—proof that the real revenue opportunity lies in solving real enterprise pain points.

Good AI Capital’s Perspective

At Good AI, we’ve backed the infrastructure and applications that make AI useful inside organizations—from healthcare to cybersecurity to manufacturing. We believe the next wave of AI value creation will come from enabling organizations to harness AI within their workflows, safely and scalably.

Meta’s investment in Scale is a milestone in that evolution. It’s a signal to founders, investors, and enterprises that the AI arms race is shifting to where real work takes place: inside the enterprise.

This is just the beginning.

Meta just bought 49% of Scale AI.

Alexandr Wang is building Superintelligence – but for who?

I wrote a warning piece on this. No fear, no hype. Just clarity.

👉 https://substack.com/@marcokindermann/note/c-125713768?r=5srf8x&utm_medium=ios&utm_source=notes-share-action

#Superintelligence #Meta #ScaleAI #WeAreNotData